Your gateway to global investments

Reputable and

secure

We're dedicated to helping South African and international clients achieve their investment goals through a user-friendly platform. As part of the Momentum Group, our platform offers clients a reputable and secure service.

Empowering financial advisers

We empower financial advisers with the information and resources to make informed investment decisions and help their clients achieve their financial goals.

Relentless

client focus

Investing offshore is an exciting journey where we put you at the centre of everything we do. Start investing today and take the first step towards a brighter financial future.

About Momentum Group

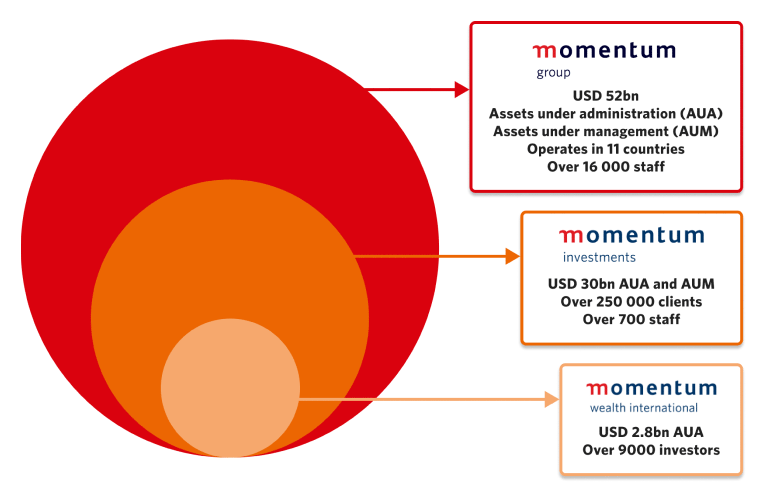

Momentum Wealth International is part of one of South Africa’s largest life insurers, Momentum Metropolitan Life Limited, a division of Momentum Group Limited, a listed entity on the Johannesburg Stock Exchange (JSE). The group operates in 12 countries and employs more than 15 000 staff worldwide.

With us, you benefit from the uncompromising stability and security that our reputational armoury provides, as well as a significant market cap of USD2.2 billion, assets under administration of USD62 billion and operational backing of the broader group.

We support you and your business throughout your journey to success

- Starting your clients’ investing journey

- Enhancing your advice process

- Supporting your business process

Starting your clients’ investing journey

Our comprehensive investment platform is designed to offer a broad range of investment capabilities to help you grow, preserve, and manage your client’s investments. We provide a highly-personalised suite of services with the tools and support you need to give your clients more certainty.

Enhancing your advice process

To enhance your advice process, our solutions integrate seamlessly with your business, giving you the flexibility to manage your client’s investments in the way that best suits you. With our tailored approach, you can sculpt personalised experiences that will leave your clients confident about their financial future.

Supporting your business process

With access to advanced insights, technical support, and a world-class investment platform, you’ll have all the tools you need to succeed. Our comprehensive support can help you elevate your business process and streamline your operations, giving you more time to focus on what really matters: your clients.

Our solutions

Personal Portfolio

The Personal Portfolio is ideal if you want to invest for the medium- to long-term and you are looking for maximum flexibility and liquidity in your offshore investment.

Minimum investment

USD25 000 or currency equivalent.

Investment period

Medium- to long-term, however, clients can access their money in their investment at any point.

Features

Wide range of investment choices –

more than 1 100 international funds to choose from.

Access to multi-currency funds within 1 contract.

Consolidated valuation reporting via our secure website or through the appointed financial adviser.

Clients have full access to their investments without penalties or restrictions.

Single or multiple ownership.

International Portfolio Bond

The International Portfolio Bond is ideal if you require a diversified offshore investment portfolio in an insurance contract.

Minimum investment

USD25 000 or currency equivalent.

Investment period

Medium- to long-term, however, clients can access the money in their investment at any point, and it may be subject to early encashment charges.

Features

Wide range of investment choices –

more than 1 100 international funds to choose from.

Access to multi-currency funds within 1 contract.

Consolidated valuation reporting via our secure website or through the appointed financial adviser.

Multiple policy option - the contract provides the option of either a single underlying policy or 100 underlying policies at the start of the contract. The single policy option will only ever have one policy, even if additions or redemptions are made. The number of policies under the 100 policy option changes when additions or redemptions are made, and whole policies are subsequently added or redeemed.

Regular Savings Plan

The Personal Portfolio Regular Savings plan is ideal for clients who want to invest regular amounts without any penalty when they stop the regular investment amount.

Minimum investment

USD1 000 or currency equivalent every month (and a minimum of USD500 or currency equivalent per fund per month).

USD10 000 or currency equivalent optional lump sum amount.

Investment period

Medium- to long-term, however, clients can access the money in their investment at any point.

Features

Wide range of investment choices –

more than 1 100 international funds to choose from.

Access to multi-currency funds within 1 contract.

Consolidated valuation reporting via our secure website or through the appointed financial adviser.

Global Wealth Endowment

A structured five-year endowment for tax-efficient investing, ideal for South African tax residents seeking pure offshore exposure while benefiting from comprehensive succession planning opportunities. It could suit high-net-worth individuals focused on intergenerational wealth transfer, liquidity, and estate planning efficiency.

Minimum investment

USD25 000 or currency equivalent

Investment period

The investment is subject to a restriction (retention) period of five years from inception.

Features

Invest with USD, EUR, and GBP. South African rand not accepted.

Income and capital gains tax are calculated within the contract, and we handle the tax reporting and administration.

Liquidity with 100 underlying policies.

Choose from a broad range of global investment components and instruments to suit any investment objective.

Secure and consolidated valuation reporting.

Global Wealth Investment

A flexible, open-ended investment structure ideal for clients who require liquidity and simplicity, who want to manage their own tax affairs, or live in tax-neutral jurisdictions. It could suit clients who have emigrated or are considering emigration.

Minimum investment

USD25 000 or currency equivalent

Investment period

No term. Clients have easy access to their offshore investment portfolio whenever they need it.

Features

Invest with USD, EUR, and GBP. South African rand not accepted.

Your tax liability will depend on your personal circumstances and where you are domiciled or resident for tax purposes.

Clients can withdraw money from their investments at any time.

Choose from a broad range of global investment components and instruments to suit any investment objective.

Secure and consolidated valuation reporting.

International Endowment Option

Ideal for clients who want a diversified offshore investment portfolio housed within an insurance contract. It combines the advantages of an insurance product (such as tax planning) with a broad choice of underlying investment funds.

Minimum investment

USD18 000 or currency equivalent.

Investment period

5 years and longer.

Features

Contributions in USD, EUR and GBP. South African Rand not accepted.

Income and capital gains tax are calculated within the contract, and we handle the tax reporting and administration.

Liquidity with 100 underlying policies.

Invest in a combination of the investment options on offer in 1 contract.

Multi-currency reporting per contract.

International Investment Option

The International Investment Option is ideal if you have a medium- to long-term investment horizon and require maximum flexibility and easy access to the money in your offshore investment contract whenever needed.

Minimum investment

USD25 000 or currency equivalent.

Investment period

Medium- to long-term, however, clients can access the money in their investment at any point.

Features

Contributions in USD, EUR, GBP CHF, AUD, HKD, and JPY. South African Rand not accepted.

Your tax liability will depend on your circumstances and where you are domiciled or resident for tax purposes.

Clients can withdraw money from their investments at any time

Invest in a combination of the investment options on offer in 1 contract.

Multi-currency reporting per contract.

Momentum Wealth International operates the Momentum Mutual Fund ICC (Incorporated Cell Company), a Guernsey-based umbrella structure comprised of many funds (called Incorporated Cells, or ICs).

Each IC is a separate legal entity and can have different investment strategies and sub-investment managers.

This means that the ICC is an ideal investment structure to house not only our Momentum-branded funds but also funds for South African Category 2 licence holders looking for a flexible and cost-efficient unitised solution for their clients.